The SARS-CoV2 virus, causing COVID-19, has already claimed hundreds of thousands of lives across the world. So far, sub-Saharan Africa (SSA) has had relatively fewer cases and lower fatality rates according to available data. Many African countries took early action to limit the entry of foreign travelers. Some put in place airport testing and quarantine procedures for those entering and many implemented stringent forms of stay-at-home requirements and workplace closures. Towards the end of May, these restrictions began to ease but there is still much we don’t know about how the virus could potentially spread.

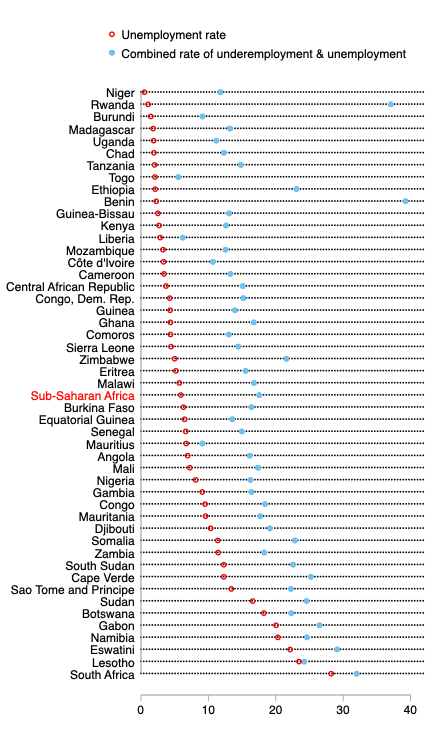

While the different forms of lockdown may have initially been beneficial to slow the spread of the virus and bought governments time to prepare their respective health sectors, they also have major impacts on people’s livelihoods through negative effects on employment and earnings. This challenge is compounded by already high levels of unemployment and underemployment. According to ILO modelled estimates, the size of the labour force (aged 15+) in SSA is approximately 430 million and in almost every country in the region, the combined rate of unemployment and underemployment exceeds 10%. The unemployment rate alone is near or higher than 20% in South Africa, Lesotho, Eswatini, Namibia, Gabon, Botswana and Sudan.

Figure 1: Unemployment and underemployment rate, 2019 (% of labour force, 15+)

Source: Author’s calculations using ILOstata (2020), ILO Modelled Estimates.

Negative impacts on the agricultural sector

Across SSA, 53% of the labour force is employed in agriculture as per the latest available data from the World Bank’s World Development Indicators (WDI). While much of this sector is essential and can continue to operate during lockdowns, there are of course negative demand side effects and local supply chain disruptions due to lockdown measures. These negative effects could potentially reduce work hours and earnings for agricultural workers.

Disruptions in global trade contribute to these negative impacts since many African countries are reliant on imported agricultural inputs. In addition, agricultural commodities are a meaningful proportion of exports in some countries. The United Nations Conference on Trade and Development (UNCTAD) has estimated that global trade will be severely affected by the COVID-19 pandemic. A recent UNCTAD report shows that China alone absorbs one fifth of the world’s commodity exports and these exports are expected to decline by between $15.5 billion to $33.1 billion in 2020. This will be felt acutely in SSA where most countries are commodity dependent – not just on agricultural commodities but also ores and metals, and oil and gas.

These disruptions threaten the livelihoods of farmers and agricultural workers, but also the food security of millions of Africans. The 2020 Global Report on Food Crisis estimates that 73 million people in Africa are acutely food insecure and the combination of the COVID-19 pandemic and locust outbreak in East Africa are expected to worsen this situation.

Informal workers

The informal sector is particularly vulnerable to the economic shock caused by this pandemic. The non-agricultural informal sector in SSA is large: it accounts for over 70% of women’s non-agricultural employment and about 60% for men. Informal workers are typically not covered by unemployment insurance, which means that the inability to work results in immediate lost income. Informal enterprises are usually small by way of revenue and capital and are less able to survive weeks of closure. These temporary closures may become permanent if owners of informal enterprises sell assets as a response to lost income. There is a real risk of a surge in poverty rates across SSA.

“Early evidence shows that the jobs that can be done from home are concentrated in high-skilled occupations, which could exacerbate within-country inequality in labour market outcomes.”

Even prior to this health pandemic, informal workers experience more vulnerability to health hazards given their poor working environments and unsanitary living conditions; and access to health insurance is lower amongst informal sector workers relative to formal workers. Certain types of informal work, such as waste-picking, are subject to higher pathogen exposure and others, such as street vending, may not allow adequate social distancing. Therefore, as lockdowns ease across different countries, many informal workers may also be at higher risk of contracting COVID-19.

Formal sector workers

More stringent lockdowns may also put many formal sector workers at risk of unemployment, lost work hours and reduced earnings, depending on the sector and occupation, as well as workers’ ability to work from home. Early evidence shows that the jobs that can be done from home are concentrated in high-skilled occupations, which could exacerbate within-country inequality in labour market outcomes. Furthermore, the share of people who work from home is strongly correlated to countries’ internet penetration. WDI data shows that about 25% of the population in SSA have access to the internet. Recent estimates of the share of jobs which can be done from home in SSA range from 5.6% in Ghana, to just above 10% in Kenya, to about 14% in South Africa. Therefore, a large proportion formal workers in non-essential sectors across SSA are vulnerable to temporary or permanent job losses due to extended lockdowns.

Export-oriented sectors are affected by reduced global trade and travel restrictions. In addition to the primary sector exports discussed above, tourism has been particularly hard hit during this global pandemic. According to WDI data, tourism receipts make up an average of 14% of total exports in SSA. According to the World Travel and Tourism Council, the travel and tourism sector is estimated to support 19.7 million jobs in SSA, which will be severely affected in the short-to medium-run.

Public sector formal workers might be more protected against employment and income losses; however, private sector formal employees remain vulnerable in the face of widespread employment impacts of the COVID-19 pandemic. The latest ILO World Social Protection Report (2017-2019) states that only 4.2% of the labour force in SSA is covered for unemployment protection under national legislation.

Looking ahead: Policy considerations

As of 22 May, 19 countries in SSA extended COVID-19 related social assistance (e.g. cash or in-kind transfers), but few have extended social insurance (e.g. paid unemployment) or enhanced labour regulation. This translates into about 19 million individuals in SSA covered by a cash transfer, or 2% of the population. This remains inadequate to address the current crisis.

There are several immediate policy actions that could mitigate the negative effects of the pandemic on the poor. These include increasing social assistance coverage, food distribution and food price regulation, access to healthcare and the widespread provision of masks, hand washing stations and sanitizers.

There are also long-term policy considerations in the face of an extended global economic downturn. A fundamental challenge for SSA is to shape its economies in ways that are able to generate decent employment for a fast-growing labour force. This is a problem of labour demand as well as weak systems of labour protection. This crisis has reaffirmed the importance of permanently extending social protection and insurance to all workers and ensuring minimum standards of working conditions across sectors.

“This crisis has reaffirmed the importance of permanently extending social protection and insurance to all workers and ensuring minimum standards of working conditions across sectors.”

Furthermore, the renewed interest in industrial policy, amongst African policy makers and within international development institutions, needs to be acted upon. One way to promote manufacturing activities in SSA that addresses the needs of climate change mitigation is to invest in cleaner forms of energy production. The African Continental Free Trade Area (AfCFTA) agreement – which 30 countries have ratified – could become the foundation for a regional based development strategy and help create a larger market for African manufactured goods. Investments in agricultural technologies and multi-country supply chain logistics have the potential to dramatically increase productivity in many African countries where agriculture represents a large proportion of economic activity and there are large available areas of arable land. This could contribute toward improved food security and the gains from increased productivity can be used to promote economic diversification into key labour-intensive manufacturing sectors. In addition, investments in ICT technologies and R&D can support long-term innovation in these key sectors.

Access to new sources of low-interest, low-conditionality funding, along with IMF debt relief, makes this an opportune time to invest in making African economies more resilient – both to this health pandemic but also to the economic challenges that lie ahead. African countries are varied in their existing economic structures but through regional institutions and policy, a coordinated effort holds promise for the achievement of structural transformation and decent employment creation.

(Main image: An aerial view of workers harvesting Chardonnay grapes in the vineyards surrounding the Iona Wine Farm in the Elgin Valley in the Western Cape province of South Africa. – David Silverman/Getty Images)

The opinions expressed in these articles are those of the author(s) and do not necessarily reflect the views of SAIIA or CIGI.